401k withdrawal calculator fidelity

Exceptions for Both 401k and IRA. However you can take.

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Publication 590-B 2019 Distributions from Individual Retirement Arrangements IRAs Charles Schwab.

. Heres how to do a 401k rollover in 4 steps without a tax bill. All of my 401k funds are invested in mutual funds and bonds. We have now placed Twitpic in an archived state.

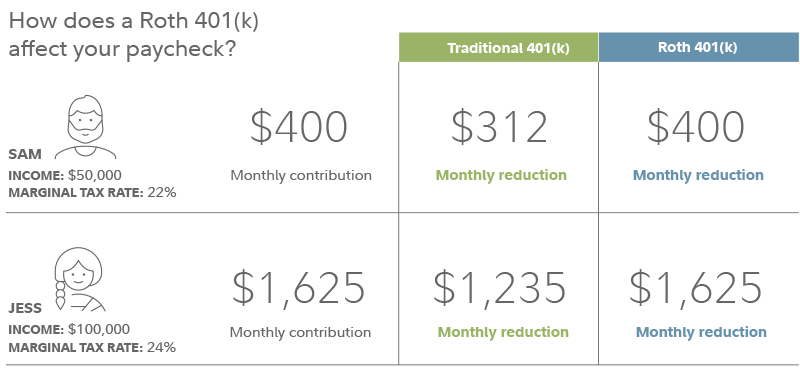

How does a 401k withdrawal affect your tax return. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. The Fidelity platform provides fractional share trading for over 7000 US.

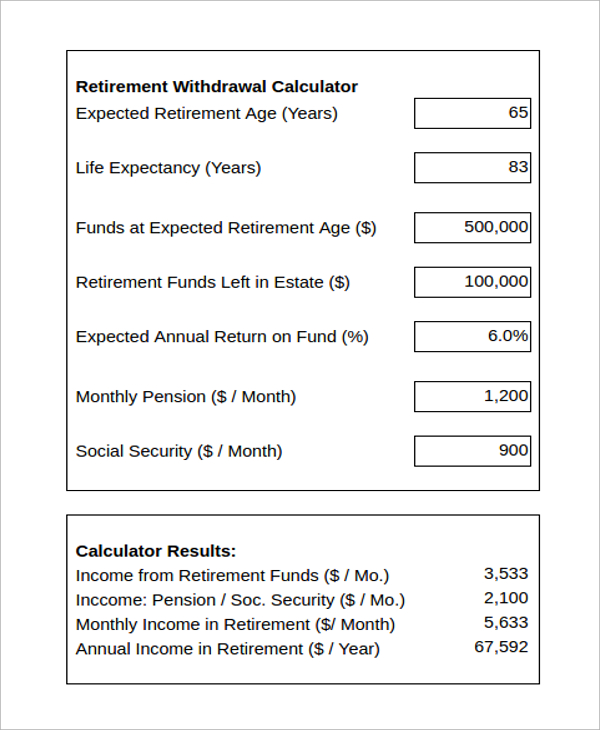

Full withdrawal is the best way to use the funds you have worked so hard to build up. Either way the monthly payment from a life annuity or SEPP withdrawal would be a much smaller dollar amount than how much you would receive by distributing 100k over a 7-year period. Rollover IRA401K Rollover Options.

The taxable portion of your withdrawal is subject to federal income tax at your normal rate. An IRS 10 withdrawal penalty may apply if you are under 59 ½. Grow your retirement savings safely.

Any withdrawal made from your 401k will be treated as taxable income and subject to income taxes in the year in which you made it before or after retirement. Retirement Topics - IRA Contribution Limits Internal Revenue Service. Thats 20 of the overall 29 trillion of retirement assets in America.

Youll report the taxable part of your distribution directly on your Form 1040. Buy Car Calculator. A 401k rollover is a transfer of money from an old 401k to another 401k or an IRA.

When you cash out your 401k before the age of 59 ½ youll be required to pay income tax on the full balance as well as a 10 percent early withdrawal penalty and any relevant state income tax. You can make a one-time also known as lump-sum withdrawal or a series of. Some employers even offer contribution matching.

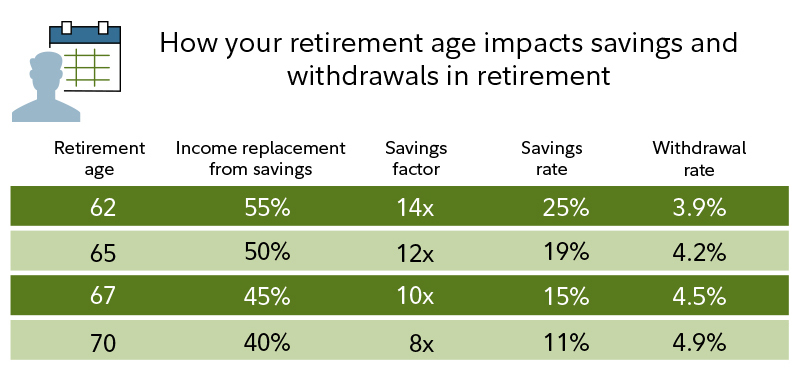

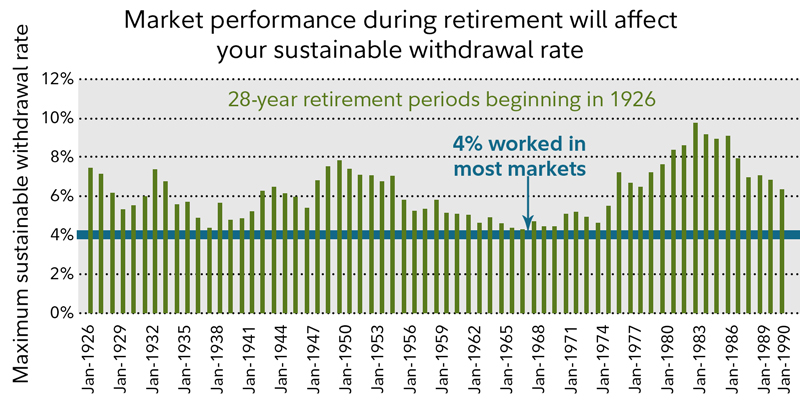

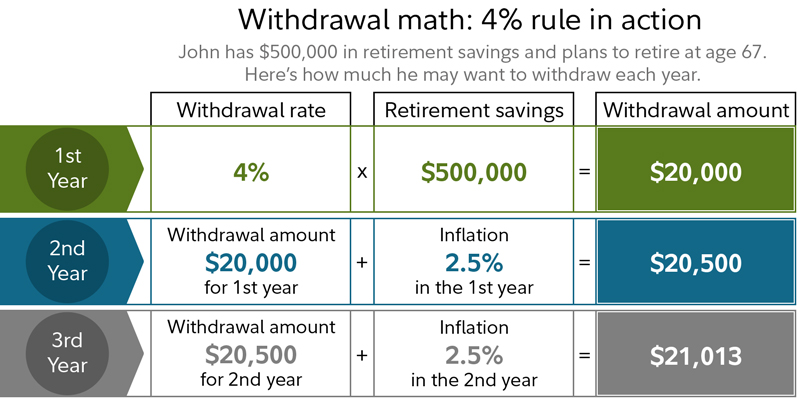

Depending on 3 or 4 withdrawal comfort level in your 401ktraditional IRA. Your age and your willingness to preserve your retirement nest egg as long as possible are factors to consider. Are not tax-deductible but earnings can grow tax-free and qualified withdrawals are tax- and penalty-free.

You may also have to pay state income tax. But just what is the. Contribute to your 401k.

If that same participant takes a hardship withdrawal for 15000 instead they would have to take out 23810 to cover taxes and penalties leaving only 14190 in their account according to a. Stocks and exchange-traded funds. The easiest way is to simply visit Fidelitys website and request a check there.

If you paid for the annuity with money on which you had not already paid income tax for example you bought the annuity within your 401k which is a type of qualified retirement plan then you. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Making a Fidelity 401k Withdrawal.

However you can also reach out via phone if you prefer. Youll also be subject to a 10 early distribution penalty if youre younger than age 59 12 at the time you take the withdrawal. I would recommend using our free quote calculator to run a quote comparison for.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Find the best annuities to grow your savings CDs 401k and IRA well into retirement safely. Roth IRA Withdrawal Rules Internal Revenue Service.

Call 800-343-3543 with any questions about the process. Roth Withdrawal Rules. Rollover IRA401K Rollover Options.

What is the best way to withdraw money from TSP. You die or become permanently disabled. Cashing out a 401k or making a 401k early withdrawal can mean paying the IRS a 10 penalty when you file your tax return.

According to the Investsment Company Institute we had over 59 trillion in assets in 401k plans as of September 2019These were being held on behalf of 55 million active participants. Dear Twitpic Community - thank you for all the wonderful photos you have taken over the years. I have my 401k plan with Fidelity and actually swapped to a Roth 401k the week that my account was opened once hired after talking to.

Exceptions to the Early Withdrawal Penalty. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. Also in the comments below from reader arisadam74 is a link to this useful 72T calculator.

You can do this through a traditional 401k IRA or a Taxable Brokerage Account. Contributions grow tax deferred until withdrawal at which. Eligible Fidelity account with 50 or more.

Open a Custodial Account Internal Revenue Service. 529 State Tax Calculator. 401k plans make up a significant part of Americans retirement planning.

Your 401k is your money and making a withdrawal is as simple as contacting Fidelity to let them know you want it. If you arent currently using a broker Vanguard Fidelity Charles Schwab Robinhood and Webull are a few options with low or no cost fee structures. How to Rollover a 401K.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Once you start withdrawing from your 401k or traditional IRA your withdrawals are taxed as ordinary income. Try to meet or exceed their matching amount to make the most of your retirement savings.

So for example if you cash out 10000 from your 401k and youre in the 22 percent federal tax bracket youll pay a total of 3200 in. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds.

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

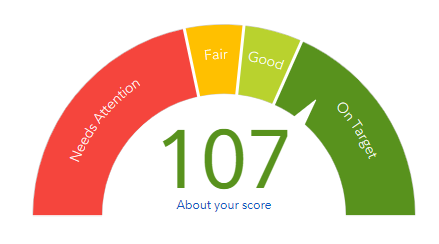

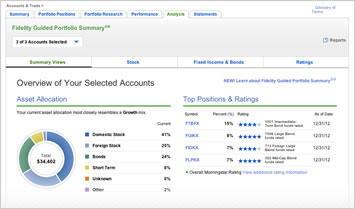

Fidelity Retirement Calculator Review

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

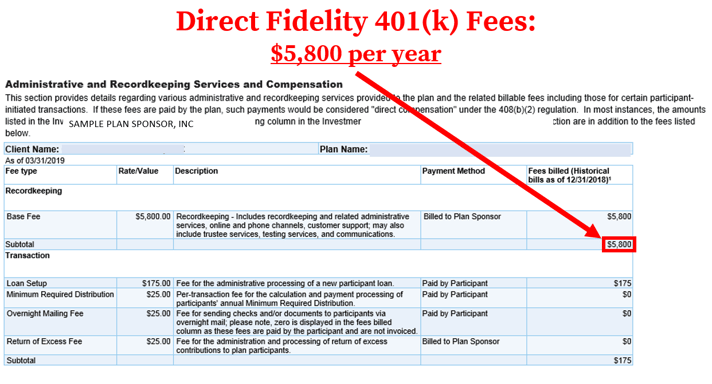

How To Find Calculate Fidelity 401 K Fees

Fidelity Says I Need 8 394 Month To Retire R Personalfinance

401k Retirement Withdrawal Calculator Outlet 60 Off Www Ingeniovirtual Com

401k Retirement Withdrawal Calculator Outlet 60 Off Www Ingeniovirtual Com

Fidelity Go Review Smartasset Com

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Fidelity 401k Calculator

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Roth 401k Roth Vs Traditional 401k Fidelity

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Listing Of All Tools Calculators Fidelity

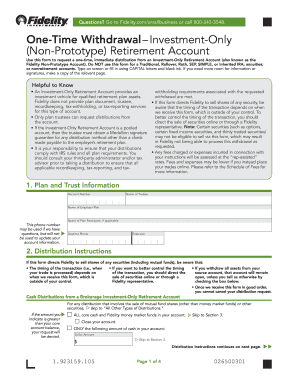

2020 2022 Form Fidelity Non Prototype Retirement Account Withdrawal Fill Online Printable Fillable Blank Pdffiller

Listing Of All Tools Calculators Fidelity